Time to Renegotiate Land Rents? Check Out These Tips

April 28, 2017

There is no shortage of experts recommending new strategies on how farmers can negotiate a good deal on land rental.

There is no shortage of experts recommending new strategies on how farmers can negotiate a good deal on land rental.

I’d like to offer a more specific approach, tailored to growers who may be dealing with retired landlords or out-of-state heirs who are managing the land.

In most cases of land rental negotiation, flex rents are suggested as a good way of approaching this negotiation. However the complexity of yield and price formulas typical of today’s larger grower is unappealing to landlords used to a simple cash rent.

New Approach to Rent Negotiations

My Trimble Ag Software accounting customers and I produce crop enterprise statements by crop and field for each landlord. These show actual inputs as well as all other variable and fixed/overhead costs at the field and acre level and finally the total cost of production by acre and per bushel. These help landlords understand the significance of overhead costs — and that they are real costs. They can also see that two US corn fields with $740/acre costs have $4/bushel cost of production when the yield is 185 bushel per acre, and $3.44/bushel when the yield is 215 bushels per acre.

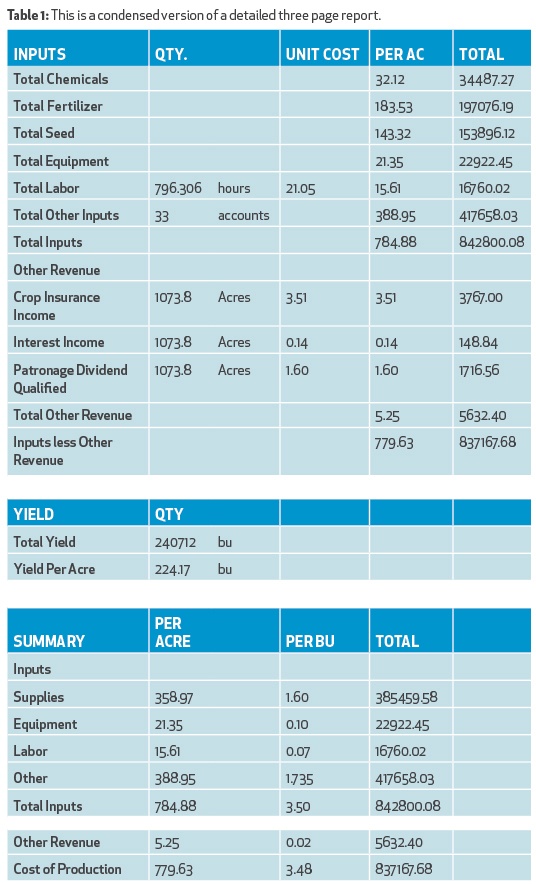

Table 1 is an example cost summary for all corn fields for one producer in 2016. The itemized details of each input and each account code have been removed for simplicity’s sake, but every single account cost is listed on the complete report.

Keep in mind these basics:

• CER (crop equivalency ratings) or CPI (crop productivity index) will vary from 54-92 in our area with many soil types and differences in soil drainage. We use our crop enterprise reports to show that some fields simply are not capable of as good a yield as others and therefore cannot support the same rent.

We print and give landlords a copy of “What is a Fair Rental Agreement for 2017” by David Bau from the Minnesota Agricultural Extension Service. David has many comprehensive past year actual returns and costs for Minnesota counties from the Farm Business Management records compiled at the Finpack center at the University of Minnesota. He also has budgets for the upcoming years and matrix tables for yield and crop price showing the amount left for rent after all other costs and a family living allowance are subtotaled. This publication is often an eye opener for landowners who do not realize that it is harder to pay $200/acre now than it was to pay $350/acre following 2012 prices.

We propose a base rent based upon the spring crop insurance price for corn with a flex adjustment if the fall crop insurance price is higher. This eliminates all price concerns about what day, what elevator bid, futures versus local basis, and other uncertainties.

Case Study

Let’s look at an example: the 2016 crop insurance price was $3.86, so we offered a rent based upon 50-65 bushels per acre x the spring crop insurance price depending upon soil productivity and drainage. This results in a rent of $193 on lower productivity land and $251 on well drained high productivity land. Another approach is that cash rent often works out to about 1/3 of total yield but this is something many landlords resist because they do not want to assume weather risk and uncertainty.

The flex is based upon corn — regardless of our cropping program for simplicity. We tell landlords that yield is our problem and we can ‘control’ it with management and crop insurance whereas price is somewhat out of our control. If opportunities are not offered by the market, we can’t fix a breakeven or profitable price when rent is high.

In 2016 the spring price was $3.86 and the Fall price was $3.49, so the landlord was guaranteed the spring price. If the fall price had been $4.49, the rents would have been $225 instead of $193 on lower productivity and $292 instead of $251 on high productivity. In these instances, the landlord would receive a nice fall bonus rent adjustment.

Many landowners in our area receive 100% of the cash rent in the Spring. This ties up lots of working capital and a higher percentage of the farm revolving line of credit operating loan. We have pointed out to landlords that ag lenders are limiting operating loan maximums to a formula based upon crop insurance revenue guarantees. As crop prices have decreased this has meant the operating loan is too small. A lender may provide $500 per corn acre and $350 per soybean acre or a 50/50 average of $425 per acre. The producer who pays $250 cash rent only has $175 left per acre for inputs and operations. In these cases; the landlord has not reduced rent but has agreed to half in the spring and half in the fall, relieving stress on the operating loan and working capital. Our producers can price some production to make the Fall rent payment over and above their usual marketing plans.

These suggestions may not work the first year a landlord is approached but a continuing appeal to fairness usually brings results over time. There are landowners who simply will take the highest bid, regardless of the effect upon the farm operator. In those cases, I urge my customers to let it go. We do not have the liberty to subsidize unprofitable fields with our profitable fields. I have been working with farm clients for 27 years and have yet to see a single customer go out of business because he gave up overpriced rented land. When one door closed, another one usually opened.

I should add that my more successful rent reduction negotiators are the fair-minded producers who voluntarily gave their landlords $25-35 bonus payments each year for about three years during the ‘good’ years. In many cases, they raised their rent from $200 to about $300 per acre over the three years, and now they have more good will to help them make necessary reductions.

I have customers being offered land parcels this week where the previous operator who was known in the community for aggressively paying big rents cannot pay the rents in today’s crop price environment and the landlord is not very sympathetic to their situation.

Remember: keep the faith, keep your landlords informed with thorough detailed reports on each of their fields. Share crop insurance APH histories and field operation photos. Work out tiling programs using long-term rental agreements. Always invite landlords to ride in the combine. My customers find value in printing yield maps from their Trimble Ag Software accounting and mapping, and a crop enterprise statement for each field.

Paul Gorman is available to help producers get cost of production at the farm and individual field level. You can reach him at drpaulgorman@yahoo.com or at 507-420-0138.